Want to buy a home? Your debt might hold you back.

“Buying a home is all about your finances,” says Ali Wolf, chief economist at NewHomeSource. “When you buy a home with a mortgage, you are asking the bank to lend you money. The bank wants to feel confident that you will be able to pay it back over time. As a result, your financial well-being, including your credit score and debt balances, is a key consideration. The last thing you want to do is find your dream home and have a bad credit score hold you back from the purchase.”

If you are finding debt to be a challenge in your pursuit of homeownership, you’re not the only one. Total U.S. household debt surpassed $18 trillion in the fourth quarter of 2024, 3% higher than a year ago. Credit card debt made up 6.7% of that total and grew faster than any other category as consumers reached for their cards more frequently amid higher inflation and increased economic uncertainty.

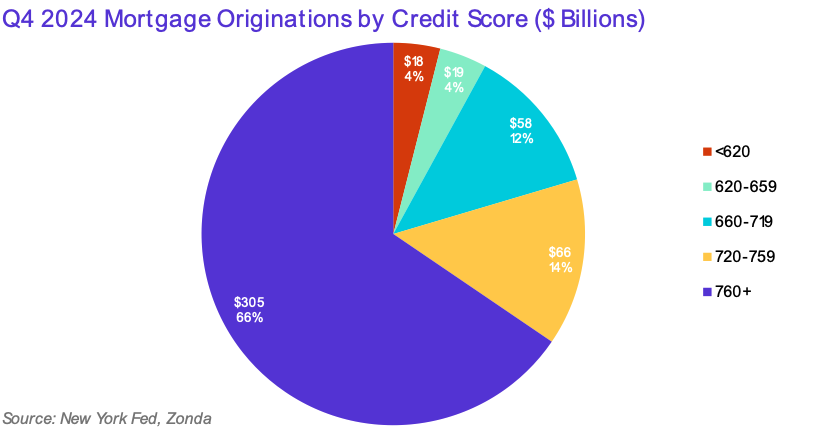

Banks are interested in your credit score when considering you for a mortgage, which is directly tied to your credit history. They have a clear preference for credit scores above 760, which made up 66% of all loans in the fourth quarter. Only 4% of loans went to those with scores below 620. According to credit monitoring bureau Experian, the average American’s score is 715.

Here are some things that help your score.

You don’t want to get too close to your credit limit. Pushing up against your maximum tells lenders that you are not able to carry more debt and makes you a riskier bet.

The longer your credit history, the better. It shows you can handle your debt and pay your bills on time.

You’ll also want to make sure there aren’t any mistakes in your credit history – you don’t want to be penalized because someone else didn’t pay their parking ticket on time.

The National Association of Realtors has ideas, too. It produced a Top 10 list of things you can do to help you on your way.

Develop a budget.

Reduce your debt.

Keep your job.

Ask for a raise.

Establish a good credit history.

Obtain a copy of your credit report.

Save for a down payment.

Consider your mortgage options.

Gather documentation.

Seek down payment help.

“Some of these things are more obvious than others,” says Wolf. “But if you put them all together, you end up in a far better financial place and have a higher chance of qualifying for a mortgage on your new home.”

Steve Ladurantaye

Steve Ladurantaye is senior vice president of content at NewHomeSource.