While much of the national economy has slowed, South Carolina has quietly pulled ahead. While national GDP contracted by 0.5% in the first quarter of 2025, South Carolina’s state GDP expanded by 1.7%, the fastest of any state. South Carolina has positioned itself as one of the most dynamic housing markets with two key ingredients for success: population and employment growth.

Through a mix of in-migration, manufacturing investment, and high-income job growth, South Carolina has become a state many builders are interested in entering or expanding in.

NewHomeSource parent company Zonda analyzed the factors behind South Carolina’s emergence in 2025 and the data that suggests the Palmetto State could be home to some of the hottest housing markets in 2026 and beyond.

Population Growth

Households continue to flock to South Carolina for the relative affordability, lower taxes, and coastal lifestyle. From young families benefitting from the strong job prospects across the state to older households seeking to enjoy their retirement years in Myrtle Beach and Hilton Head, South Carolina is home to markets that are broadly appealing to a variety of households.

Since 2020, the state has average 1.7% annual growth in population and South Carolina gained 68,000 new residents in 2023-2024 alone. Upon further analysis, several markets within the state stand out for their population and employment growth:

Myrtle Beach. The coastal metro led the state with a 5.7% year-over-year increase in jobs from July 2024 to July 2025, supported by airport expansions and a tourism-driven economy. Given the market is home to many retirees, Myrtle Beach is also a booming market for healthcare and social assistance workers.

Charleston. The market experienced a 3.8% annual gain in jobs, driven largely by port activity.

Columbia. The state’s capital grew 2.7% year over year, fueled by government jobs and the presence of the University of South Carolina.

Greenville. Given the influx of major manufacturing employers like BMW and Michelin, the market recorded 2.3% growth compared to 2024.

High-Income Employment and Future Growth

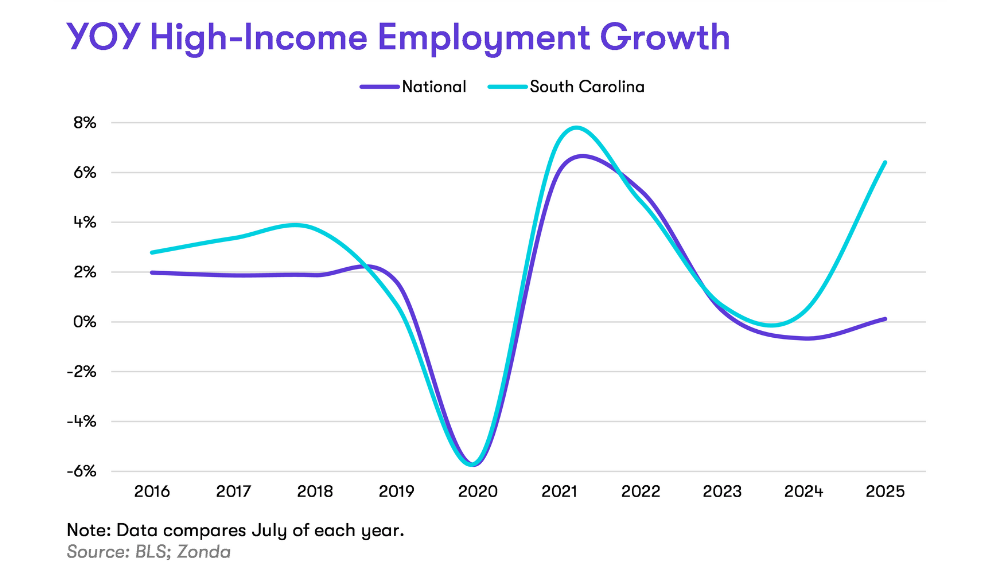

In South Carolina, high-paying sectors have experienced outsized growth, a positive sign for both the local economy and the housing market. Jobs in the information, financial activities, and professional and business services sectors pay employees an above-average salary, making these employees candidates for homeownership in a challenging housing market.

Since 2020, high-income employment has surged by approximately 3.0% by year in South Carolina. Over the past year alone, South Carolina added 6.4% more high-income jobs, besting growth in Texas (1.2% growth), New York (0.2% growth), and California (2.0% decline).

These trends are likely to continue, with several major corporations announcing investments in South Carolina.

Google added two new data centers in Dorchester County 2024, creating hundreds of jobs.

BMW committed $1.7 billion to expand electric vehicle production in South Carolina and build a battery plant in Woodruff, South Carolina. The battery plant is slated to open in 2026, bringing hundreds of additional jobs online.

Boeing’s $1 billion expansion in north Charleston is projected to create 500 new jobs over the next five years.

Schneider Electric’s $23.8 million expansion of facilities in Seneca and Columbia will add nearly 300 more new jobs in the manufacturing sector.

A $300 million mixed-use development in Hardeeville within the Hilton Head metro will create 200 new jobs across 50 businesses, 10 restaurants, three hotels, and a grocery store.

What does this mean for buyers?

The growth in both population and high-income employment is already driving housing demand across the state. Zonda reports markets like Columbia, Spartanburg, and Charleston have all outperformed their historical norms in 2025.

For prospective buyers, this means:

More Inventory: Builders are likely to respond to demand with new housing developments, especially in growth corridors near major job centers.

More Competition: As higher-income buyers move into the state, competition homes will likely intensify especially in desirable school districts and near employment hubs.

With a growing economy, expanding job market, and a steady stream of new residents, South Carolina is poised to be one of the more opportunity-rich housing markets in the coming years. For home shoppers, now may be the right time to act – before rising demand drives prices even higher.