Each month, NewHomeSource parent company Zonda surveys homebuilders, taking a pulse of the current market. The builder-focused insights capture market sentiment, trends, and shifts. For homeowners and prospective buyers, these insights can be incredibly valuable to understand what is happening and what could be coming in the housing market.

The main takeaways from the November report center around costs, both to consumers and to builders.

Prospective buyers are likely to find lower prices in the new-home market due to rate buydowns and wholesale price cuts.

Many builders are likely to feel more comfortable about these offerings due to improvements in supply-side costs.

Slower Demand, Lower Prices

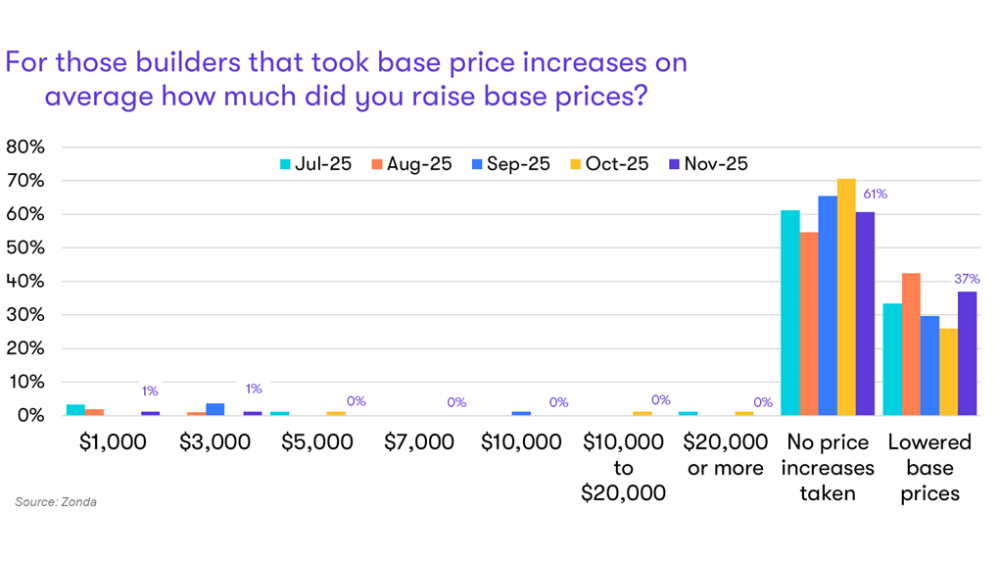

According to Zonda’s survey, 40% of builders lowered prices during the month. The primary tactic for this was mortgage rate buydowns into the 4%s—offered by 60% of builders. However, even with lower prices and rate buydowns, 70% of builders reported that demand was slower than expected. Builders are noting that prospects are taking slower to commit to deals than in previous months even with financing incentives and price cuts.

The frequency of price cuts should mean prospective buyers are able to find deals in the market before year’s end. Many builders are discounting homes ready to move in within 90 days, called quick move-in inventory, in order to bolster sales before the end of the calendar year.

Supply Side Costs Improve

Despite the challenges facing builders in today’s housing market, 45% reported overall costs were down year-over-year in November. An additional 32% said they were flat. While regulation and land costs are increasing, materials and labor costs have generally improved. For buyers, this is good news. A better cost structure likely means builders will feel more comfortable offering financing incentives, given the high cost of offering these deals are being offset by supply-side efficiencies.

Labor Disruptions More Frequent

In November, 13% of builders reported labor-related disruptions, the highest share recorded in over two years. This was a direct reflection of increased ICE activity, impacting the willingness of trade partners to show up and activity at job sites. While builders have largely improved cycle times throughout 2025, these labor concerns are a headwind to keep an eye on moving into 2026. How they impact builders and build times could affect prices and inventory for buyers in 2026. While most builders suggest ICE impacts could be fleeting, it is a trend prospective buyers should be aware of moving forward.