Everyone wants to live somewhere stable, with a strong economy that will help them provide for their family and live a life of quiet comfort. One way to do that is to pick up stakes and move to a city with numerous Fortune 500 headquarters.

NewHomeSource research shows that these companies are undeniable economic engines. They shape the markets in which they operate, influencing everything from employment to infrastructure and housing demand.

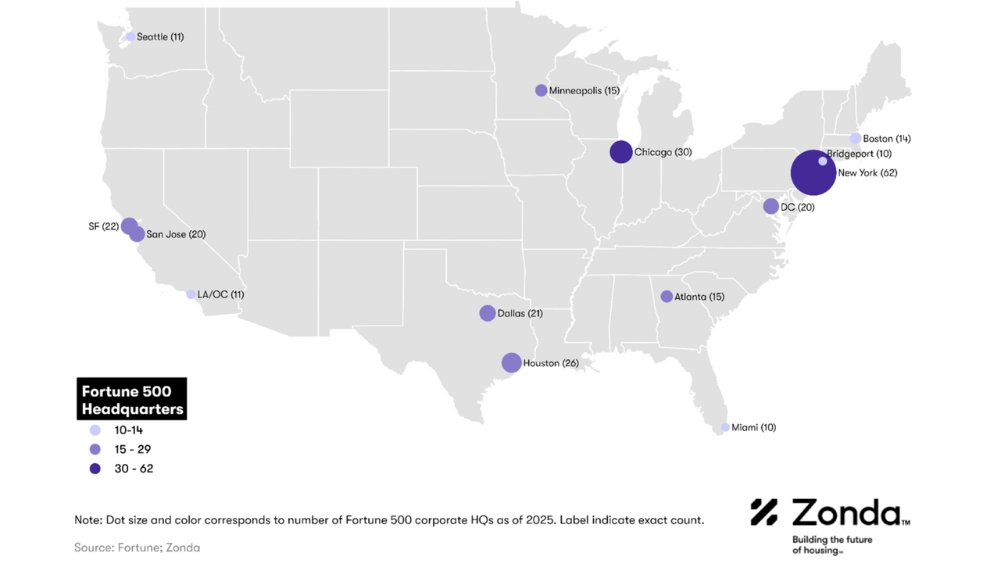

New York City nabbed the top spot yet again. NYC has the most Fortune 500 HQs (62), with companies like JP Morgan Chase, Citigroup, and Verizon calling the Big Apple home.

Chicago and Houston rounded out the top three. These two markets held steady from last year at the #2 and #3 spots, respectively. Chicago is home to 30 HQs, including McDonalds, United Airlines, and Kraft Heinz. While many of Houston’s 26 HQs are rooted in the oil and energy sector (think Chevron, ExxonMobil, and Phillips 66), the market also hosts corporations like Sysco and Waste Management.

San Francisco (#4) and Dallas (#5) nearly tied at 20 HQs each. Major employers in San Francisco include Wells Fargo, Uber, and Salesforce, while Dallas is home to AT&T, Texas Instruments, and Southwest Airlines.

Two markets stand out for having a much higher HQ rank than population rank: Bridgeport/Stamford, Connecticut (10th for HQs, 59th for population) and San Jose, California (7th for HQs and 36th for population). These two also boast the most favorable headquarters-to-population ratios, with one HQ per 95K people in Bridgeport/Stamford and one per 97K people in San Jose.

On the flip side, two other large-population centers – Los Angeles (12th for HQs, 2nd for population) and Miami (14th for HQs and 9th for population) – underperform relative to their size.

Los Angeles: It’s a different economic structure. Los Angeles is unique in that, while there is a downtown, there isn’t one clear central business district where most economic activity is concentrated. Instead, its diverse industries – including entertainment, fashion, trade, aerospace, healthcare, tech, real estate, and tourism – are dispersed across the metro area. This fragmentation, combined with a less favorable business environment and low housing affordability for workers, helps explain LA’s relatively low number of Fortune 500 HQs. That said, this absence is not necessarily a sign of a struggling local economy, as the diversity of LA’s economy remains a strength, even if it doesn’t align with traditional HQ clustering.

Miami: international activity and branch offices. Miami has long enjoyed a thriving economy, historically fueled by tourism, hospitality, and real estate. The pandemic, however, significantly elevated the city’s profile for many corporations, particularly for financial firms based in New York City. As remote work became widespread, many companies and individuals redirected their attention from the Big Apple to Miami’s sunny climate and dynamic lifestyle, earning the city the nickname “Wall Street South.”